So…what is it?

The Parish Giving Scheme (PGS) is an established service for managing Direct Debit giving, designed to support churches to fund their mission and ministry. It reduces the burden of work on church volunteers and provides a simple and secure service to givers.

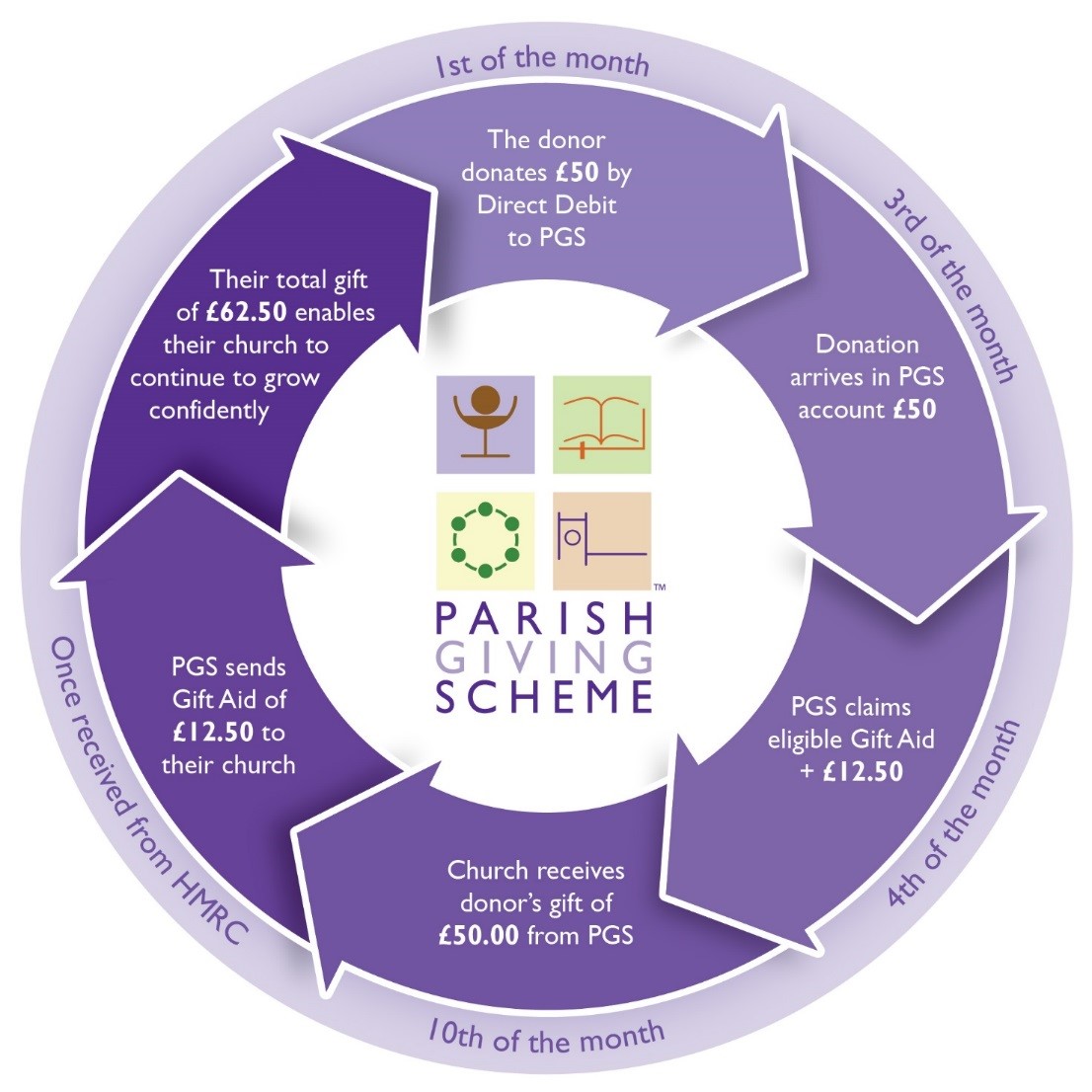

Donations through this Scheme are made by Direct Debit, and can be given on a monthly, quarterly or annual basis. Each donation is directed to that individual's parish church, and PGS claims the Gift Aid on your behalf.

While PGS doesn’t need to completely replace your current planned giving arrangements, if this Scheme becomes the default giving method for your church you will not only be offering inflation-proofed giving but also reducing your administration, which will release your parish to focus on other important priorities.

We currently have over 70 parishes registered and using the Scheme – that’s roughly one third of our local parishes - with almost 1,200 people using the PGS each month. This year they will contribute over £1 million to their local parishes.

Why should my parish sign-up?

- fewer cash donations means lower risk for volunteers counting and banking money

- donors have the option to increase their gift by inflation, maintaining the value of their gift and sustaining the church's mission and ministry

- donors can set up their giving through the PGS website, phone service or a paper form, depending on their preference

- Gift Aid is claimed by the Scheme, so administration for your local church is reduced, saving time and work

- the Scheme is offered free of charge to churches and donors

- the Scheme transfers the gift and the Gift Aid to your parish bank account on a monthly basis, improving cash flow and the security of gifted income

How does it work?

How to join the Parish Giving Scheme

Before givers can sign up, the parish itself must be registered. This needs to be decided by the PCC, who then need to download the correct registration form (below) and return it to our Parish Giving Advisor along with a proof of bank details such as a paying in slip or copy of your bank statement.

How to register as a giver

PGS has a full digital service, allowing givers to set up their giving through the PGS website. Every church has a landing page which draws information through from A Church Near You, making it really easy for people to find the correct church and reduce the need to maintain another web presence.

Statement Receivers can also download monthly statement from within the website, and can save a free QR code to help promote the Scheme to your community.

Once the parish is registered, there are three ways in which a giver can set up their Direct Debit to donate regularly to the church or parish:

- via the PGS website

- via the telephone service on 0333 002 1271, Monday to Friday, 9am - 5pm

- via paper 'Gift Form' – available from our Parish Giving Advisor. Please state how many you need and where to send them to.

- via a PGS Gift Form. Please make sure these forms are in colour and good quality. Before printing, we recommend pre-filling the form with your PGS code and parish name, so there is less form filling for the Giver.

One-off Donations!

The Parish Giving Scheme now offers a one‑off donation service, making it simple for people to give occasional gifts alongside regular giving. Your church supporters can make a single payment online, and the parish receives the funds directly with Gift Aid added where applicable. It’s quick, secure, and designed to help churches benefit from spontaneous generosity without extra administration!

Promoting PGS in your parish

If the Parish Giving Scheme is available in your church, it is important to communicate this and let people know who they can talk to about joining.

- Click here for a poster with space to manually add your PGS details

- Click here for an editable poster with space to add your PGS details (requires Canva)

To find out more about the Parish Giving Scheme, or to register your parish, contact our Parish Giving Advisor Rev Paul Child here.

Gift Aid small donations scheme (GASDS) eligibility

In any tax year GASDS eligibility is ten times the amount of donations for which the PCC submits a Gift Aid claim to HMRC. This excludes donations received through the Parish Giving Scheme. To be able to claim GASDS, all PGS churches will need to submit at least one direct Gift Aid claim each tax year. To be able to claim the maximum amount of GASDS (£8,000) the church will need to submit a claim for Gift Aid on £800 of donations (800 x 10 = £8,000).

Key Updates in 2025

Website upgrade - The PGS website underwent a significant update, and services have been fully restored.

Smooth transition to Go Cardless – The scheme has successfully moved to a new transaction provider, ensuring reliable processing and improved efficiency.